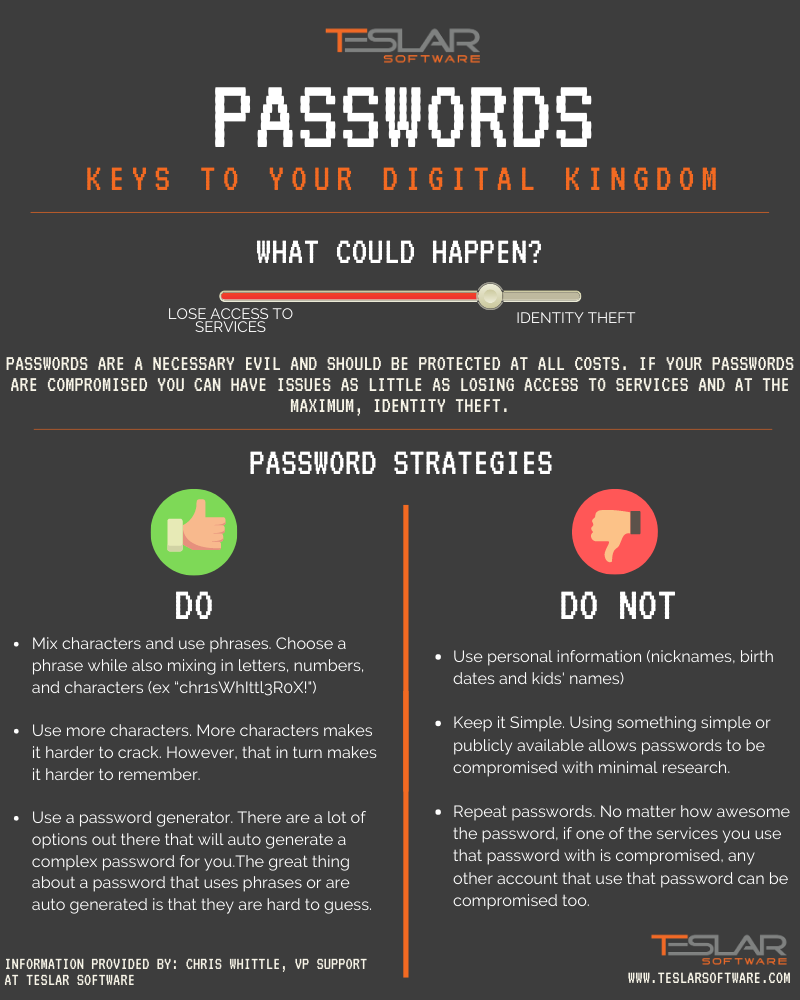

Teslar Software Predicts Next Steps, Opportunities for Business Lending in 2021

Teslar Software, a provider of automated workflow and portfolio management tools designed to help community financial institutions thrive, today shined a light on predictions and opportunities for community bankers to develop their business relationships in 2021.

-png.png)

.png)